The Ultimate Overview to Property Financial Investment in New York

New York, a worldwide center of finance, culture, and technology, continues to be among one of the most popular places for real estate financial investment. Whether you're a experienced financier or a novice wanting to get into the marketplace, recognizing the subtleties of real estate investment in New York is important. In this overview, we will certainly discover why New york city is a prime location genuine estate financial investment, the key areas to consider, and important suggestions to maximize your returns.

Why Purchase Realty in New York City?

1. Market Security and Development:

New york city's realty market has revealed strength and regular development for many years. In spite of financial changes, the demand for properties continues to be high, making it a secure financial investment option. The city's varied economic climate and population growth continue to drive demand throughout numerous fields.

2. High Rental Returns:

New York is renowned for its high rental yields, especially in locations with high need and restricted supply. This makes rental homes particularly profitable, offering capitalists the possibility for considerable passive earnings.

3. Global Appeal:

As a international city, New York brings in people from all over the globe, whether for service, education, or leisure. This global charm ensures a constant increase of tenants and customers, improving the market's dynamism and financial investment capacity.

Key Locations for Real Estate Financial Investment in New York

1. Manhattan: The Center of High-end and Business

Manhattan continues to be a top selection for real estate investors, understood for its luxury apartments, commercial homes, and historic structures. Locations like Midtown, Tribeca, and the Financial Area are prime places for high-end household and commercial financial investments. The constant need for luxury living and workplace ensures a robust rental market.

2. Brooklyn: The Growing Borough

Brooklyn has actually changed into among the most dynamic locations for real estate financial investment. Areas like Williamsburg, DUMBO, and Greenpoint are particularly prominent, offering a mix of historic appeal and modern facilities. The district's interest young specialists and creatives remains to drive residential or commercial property values and rental rates up.

3. Queens: Affordable Opportunities with High Possible

Queens is gaining recognition for its price and development possibility. Locations like Long Island City, Astoria, and Flushing are experiencing significant growth, bring in both property and business investors. The approaching facilities tasks and varied cultural scene make Queens a hotspot for future growth.

4. The Bronx: Emerging Market with High Returns

The Bronx provides a few of one of the most inexpensive realty chances in New york city. Areas like Riverdale, Kingsbridge, and the South Bronx are seeing raised financial investment as a result of their possibility for appreciation. The area's redevelopment projects and community revitalization efforts are making it an attractive option for savvy investors.

5. Staten Island: Suburban Appeal with Urban Access

Staten Island combines country peace with simple access to Manhattan. Areas like St. George, Stapleton, and Bayonne are suitable for residential investments, supplying family-friendly areas with a expanding need for rental residential properties.

Tips for Effective Realty Investment in New York

1. Research and Due Persistance:

Detailed study is necessary. Understand market patterns, home values, and area characteristics. Conduct due diligence to evaluate the property's condition, lawful condition, and capacity for appreciation.

2. Utilize Funding Options:

Discover different financing alternatives offered in New York, consisting of standard mortgages, exclusive lending institutions, and real estate financial investment loans. Understanding your funding options can improve your acquiring power and ROI.

3. Deal With Regional Experts:

Partnering with seasoned property agents, lawyers, and home supervisors that know the New york city market is invaluable. Their regional competence can assist you navigate the intricacies of property transactions and administration.

4. Expand Your Profile:

Consider diversifying your investments throughout different residential property https://greenspringscapitalgroup.com/ kinds and areas. This strategy can reduce threats and make the most of returns, whether you're purchasing property, business, or mixed-use homes.

5. Stay Updated on Laws:

New york city's property market is subject to numerous laws and zoning Real Estate Investment New York legislations. Keep informed about neighborhood ordinances, rent control policies, and tax obligation ramifications to guarantee conformity and protect your financial investment.

Realty investment in New York supplies unequaled opportunities for growth and earnings generation. From the dynamic streets of Manhattan to the arising markets in the Bronx, New york city's diverse communities provide a wide range of alternatives for financiers. By recognizing the marketplace, leveraging regional competence, and remaining educated regarding patterns and policies, you can successfully browse New york city's dynamic real estate landscape.

Beginning your financial investment trip today and unlock the capacity of New York's real estate market. Whether you're searching for a high-end condo in Manhattan or a promising residential or commercial property in Queens, New york city's realty market is ready to invite you with open doors.

Destiny’s Child Then & Now!

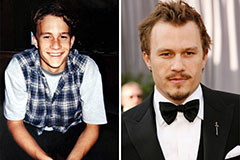

Destiny’s Child Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!